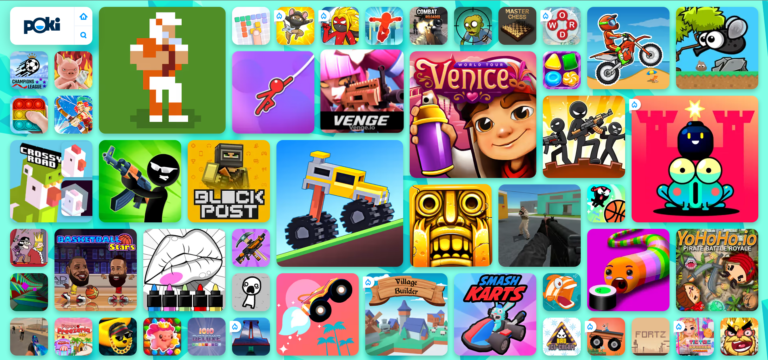

In the vast realm of the internet, free online games stand as a beacon of entertainment, offering a diverse array of experiences to players worldwide. Let’s embark on a journey to explore the dynamic landscape of free online gaming, from casual pastimes to immersive multiplayer adventures.

1. The Diversity of Free Online Gaming

A Multifaceted Playground

Free online games encompass a broad spectrum of genres, catering to a diverse audience with varying tastes and preferences. From classic arcade games to intricate strategy simulations, there’s something for everyone in the digital realm. Whether you’re a casual gamer seeking quick thrills or a dedicated enthusiast craving epic quests, the world of free online gaming has you covered.

Hidden Gems and Underappreciated Treasures

Amidst the sea of popular titles, lesser-known gems abound, waiting to be discovered by intrepid players. Indie developers and passionate hobbyists contribute to the richness of the free online …

Continue reading